Rome, 05 November 2025 15:22 Inside Information

- Order Backlog came to € 47.3 billion. Book-to-Bill ratio at 1.4x

- Revenues and EBITA growth in line with expectations and the sustainable growth path envisaged in the Industrial Plan

- Net Result before extraordinary transactions € 466 million (+28% vs 9M2024)

- Improvement of Free Operating Cash Flow (FOCF), demonstrating the effectiveness of the actions undertaken

- Group Net Debt improves to € 2,313 million (-25.9% vs 9M2024)

- BoD appoints Giuseppe Aurilio as new Chief Financial Officer (CFO)

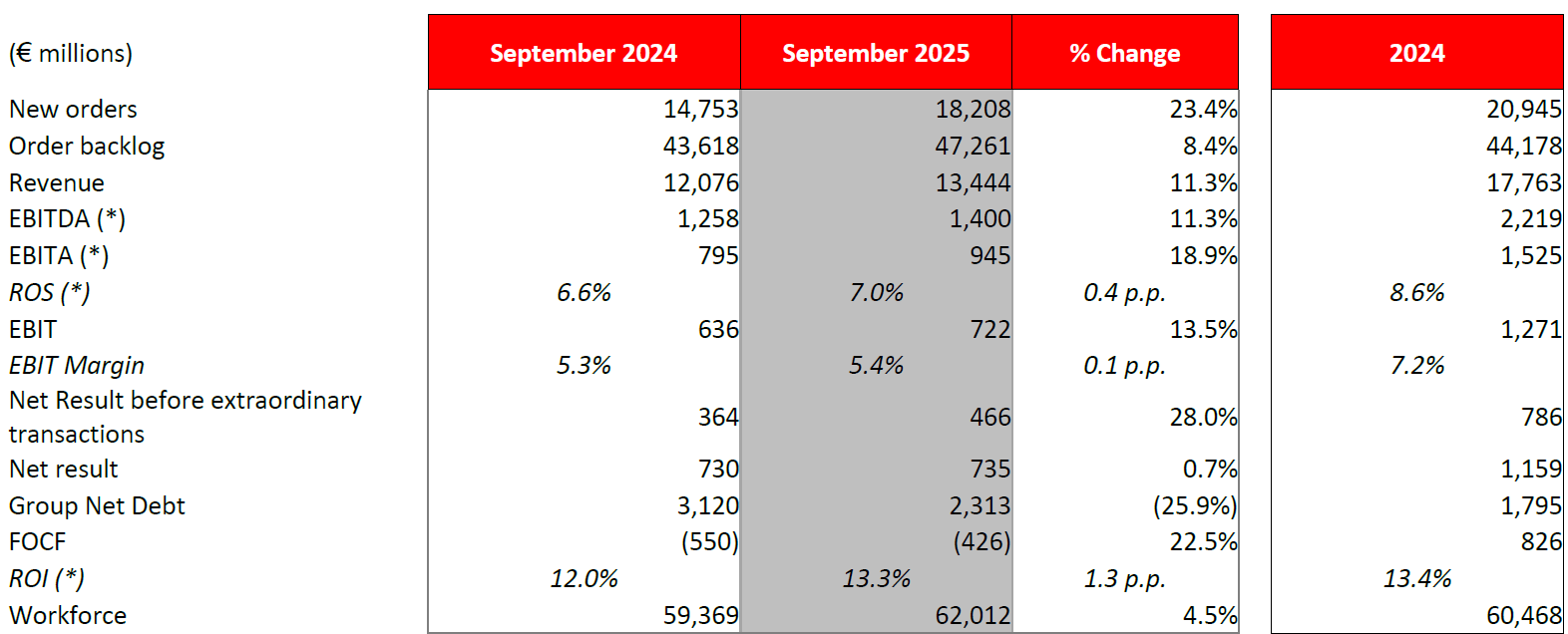

(*) Figure at 30 September 2024 is presented in restated form as a result of the revision of the KPI with reference to the valuation of strategic investments

*******************

Leonardo's Board of Directors, convened today under the Chairmanship of Stefano Pontecorvo, examined and unanimously approved the 2025 first nine months results.

“The results for the first nine months of 2025 confirm the Group’s positive performance. Steadily volume growth and solid profitability continue to underpin our competitive positioning in both domestic and international markets. We reaffirm our 2025 guidance - revised upwards last July with more ambitious targets for orders, FOCF and net debt - as well as our commitment to the timely execution of the Industrial Plan, which is progressing in line with the identified strategic priorities. We have further pursued our path of inorganic growth through the acquisition of Iveco Defence, and, in the context of strengthening European alliances, we have signed an MoU with Airbus and Thales to establish a new company in the space sector. This initiative aims to reinforce Europe’s strategic autonomy in space and further consolidates Leonardo’s role as a leading player in the Aerospace, Defence and Security domain,” stated Roberto Cingolani, Chief Executive Officer and General Manager of Leonardo. “Following the appointment of the new Chief Financial Officer, I would like to express, on behalf of the Group, our sincere gratitude to Alessandra Genco for her invaluable contribution and dedication to Leonardo over the years”, Cingolani concluded.

9M2025 financial results

The good performance of the Group was consolidated in the first nine months of 2025, confirming its competitive positioning in both domestic and international markets supported by steadily growing volumes and a solid profitability. The good performance of the period, compared with the same period of the prior year, is even more significant inasmuch as it does not include the contribution from the Underwater Armaments & Systems (UAS) business, which had been recognised under the Defence Electronics & Security sector until 2024 and sold to Fincantieri in early 2025.

In the first nine months of 2025, New Orders increased significantly reaching €bil. 18.2 (+23.4% compared to the figure of the comparative period, +24.3% compared with the like-for-like figure), confirming the continuing strengthening of the core businesses and also as a result of an important order in the Aeronautics sector, within a market environment where demand for security remains high. The book-to-bill stood at 1.4.

Revenues came to €bil. 13.4 showing a significant increase (+11.3% compared to the figure of the comparative period, +12.4% compared with the like-for-like figure), and EBITA was equal to €mil. 945 (+18.9% compared to the restated (*) figure of the comparative period, +22.7% compared with the like-for-like figure), in line with expectations and the sustainable growth path envisaged in the Industrial Plan of Leonardo.

Free Operating Cash Flow, negative for €mil. 426 as a result of the usual interim trend, showed an improvement compared to the comparative period (+22.5%, +22.3% compared with the like-for-like figure) demonstrating the effectiveness of the actions undertaken. The FOCF performance and the consideration received as part of the sale of the UAS business, equal to about €mil. 446, result in a positive effect on the Group Net Debt, down by about 25.9% compared to 30 September 2024.

(*) The figure for the comparative period is presented in restated form as a result of the revision of EBITA, starting from the 2024 Financial Statements, with reference to the valuation of strategic investments.

Key Performance Indicators (KPIs)

(*) The figure at 30 September 2024 is presented in restated form as a result of the revision of the KPI with reference to the valuation of strategic investments. Specifically, starting from the 2024 Financial Statements, the share of net result of strategic investees, which is already recognised within the Group's EBITA as part of their valuation at equity, now no longer includes any non-recurring, extraordinary or non-routine items in the income statement; in line with Leonardo’s policies and the approach already applied to companies consolidated on a line-by-line basis, these items are deducted from EBITA in order to show profit margins that are not affected by volatility elements. The revision described above also impacted EBITDA and the performance indicators ROS and ROI, while it had no effects on other indicators.

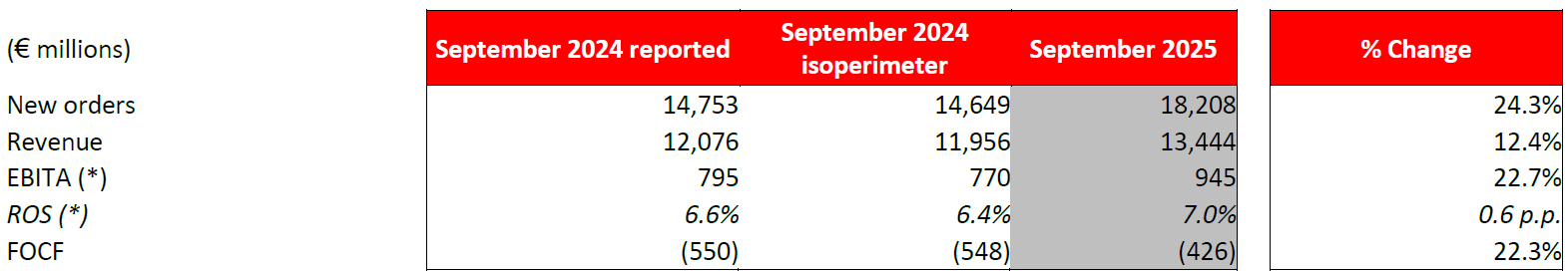

As indicated above, following the finalisation of the sale to Fincantieri of the Underwater Armaments & Systems (UAS) line of business, occurred on 14 January 2025, the figures at 30 September 2025 do not include the contribution from such business that, vice versa, was recognised within the Defence Electronics & Security sector until 2024. In order to make the Group's operational performance more comparable, for some performance indicators we report below the figure of the comparative period – and the related change compared to the current period – excluding the contribution from the UAS business (like-for-like perimeter):

(*) The figure at 30 September 2024 is presented in restated form as a result of the revision of the KPI with reference to the valuation of strategic investments.

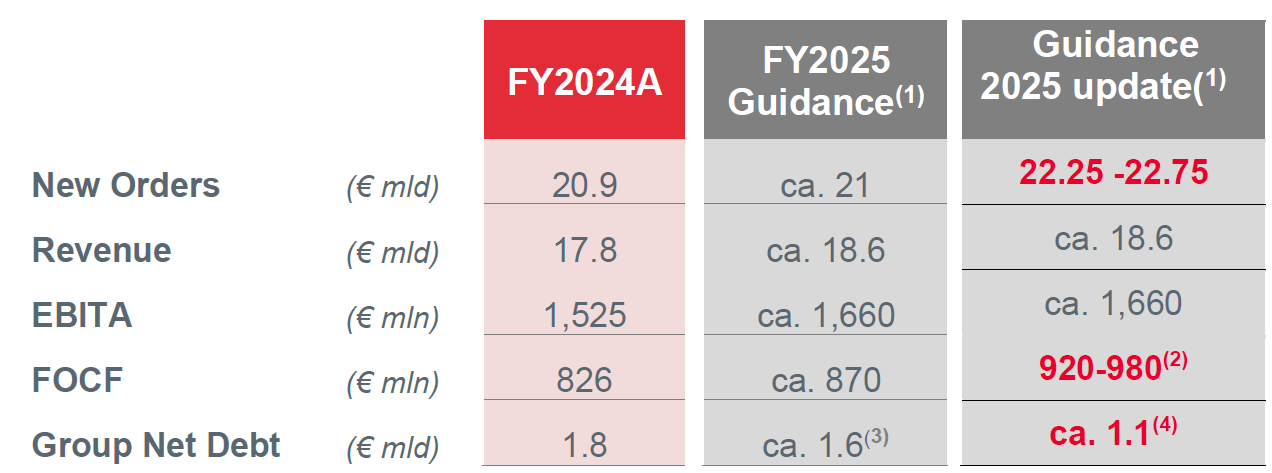

2025 Guidance

According to the first nine 2025 results and the expectations for the coming quarter, we confirm full year 2025 Guidance updated in July 2025.

This is summarised in the table below:

Based on USD/€ exchange rate at 1.08 and €/GBP exchange rate at 0.86

(1) Based on the current assessments of the impacts of the geopolitical situation also on supply chain, tariffs, inflationary levels and the global economy, subject to any further significant effects

(2) Including the effects deriving from the resolution of the dispute concerning the Norwegian NH90-program

(3) Assuming the increased dividend payments from €0.28 to €0.52 per share, M&A transaction of ca. €500 million, DRS shareholders remuneration, new leasing contracts and other minor movements

(4) Assuming the increased dividend payments from €0.28 to €0.52 per share, M&A transaction of ca. €100 million, DRS shareholders remuneration, new leasing contracts and other minor movements

Commercial performance

- New Orders reached €bil. 18.2, sharply increasing (+23.4%, +24.3% compared with the like-for-like figure) compared to the first nine months of 2024, driven by the excellent performance of Aeronautics which benefitted from the acquisition of an important order for the provision of an integrated logistic support and the training of the Eurofighter aircraft fleet of the Kuwait air force. The other business sectors were also increasing, as a result of the commercial success and good positioning of products, the Group’s technologies and solutions, as well as the ability to effectively oversee key markets. The level of new orders is equal to a book to bill (the ratio of New Orders to Revenues for the period) of about 1.4.

- The Order Backlog ensures a coverage in terms of production exceeding 2.5 years.

Business performance

- Revenues (€bil. 13.4) showed a significant increase compared to the first nine months of 2024 (+11.3%) in all the business sectors, despite the change in the perimeter related to the sale of the UAS business (+12.4% on a like-for-like perimeter). Particularly significant is the contribution given by the Defence Electronics & Security, both in its European component and for the subsidiary Leonardo DRS, and by Helicopters and Aeronautics, with specific reference to the Aircraft component.

- EBITA (€mil. 945), which increased significantly compared to the comparative figure in almost all sectors (+18.9% against the restated figure), reflects the growth of volumes and the solid performance of the Group’s businesses. The period was particularly affected by the result of the Helicopters and the Defence Electronics and Security sectors, despite the negative impact of exchange rate effect on the results of the subsidiary LDO DRS, which more than offset the expected performance of the strategic investee GIE ATR and of the Aerostructures within the Aeronautics sector. An improvement was also reported by the Space sector, which benefitted from the efficiency-improvement actions on the manufacturing segment of the Space Alliance. The good performance of the Group is even more evident if we exclude the contribution from the UAS business from the comparative figure (+22.7% on a like-for-like perimeter).

- EBIT, equal to €mil. 722, also showed growth (+13.5%), despite the increase in non-recurring charges which mainly reflect the effects deriving from the resolution of the dispute concerning the Norwegian NH90-program, in addition to the costs incurred in the context of important industrial operations.

- The Net Result before extraordinary transactions of €mil. 466 (€mil. 364 in the comparative period), benefitted from the improvement in EBIT and lower net financial costs, mainly attributable to the improvement in the Group’s Net Debt.

- The Net Result of €mil. 735 included, in addition to Net Result before extraordinary transactions, the capital gain recognised following the sale of the UAS business to Fincantieri, equal to about €mil. 283, partially offset by the costs of the disposals finalized in the previous periods. The figure related to the comparative period (€mil. 730) benefitted from the capital gain – equal to €mil. 366 – recognised following the fair value measurement of the Telespazio group performed for the purpose of the line-by-line consolidation of the latter.

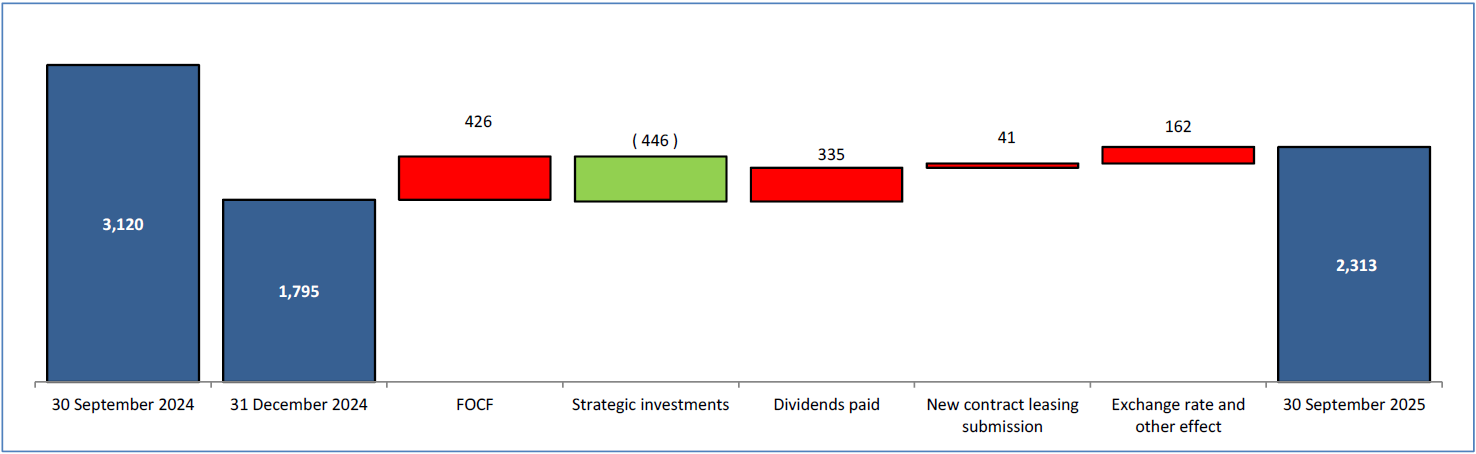

Financial performance

- FOCF in the first nine months of 2025, negative for €mil. 426, showed an improvement compared to the performance at 30 September 2024 (negative for €mil. 550, negative for €mil. 548 compared with the like-for-like figure), confirming the positive results reached thanks to the effect of initiatives to strengthen operational performance and collection cycle, a careful investment policy in a period of business growth with stringent priorities, an efficient financial strategy and an effective management of working capital. The figure, which is however impacted by the usual interim trend characterised by cash absorptions during the first part of the year, is also affected, compared with the first nine months of 2024, by higher receipts and dividends received, partially offset by an increase in the investments and an acceleration in supplier payments to underpin the growth path.

- The net change in loans and borrowings included the repayment, occurred in March 2025, of the bonded loan of Leonardo S.p.a. issued in 2005 and amounting to €mil. 500, which reached its natural maturity date, partially offset by the drawing of the €mil. 260 Sustainability-Linked loan granted by the European Investment Bank (EIB).

The Group Net Debt, equal to €mil. 2,313, decreased compared to September 2024 (down about €bil. 0.8), thanks to the strengthening of the Group's cash generation and to the cash-in of the total amount of €mil. 446 arising from the sale of the UAS business.

Compared to 31 December 2024 (€mil. 1,795) the figure increased mainly as a result of the abovementioned FOCF performance, net of the effect of the abovementioned sale of the UAS business, in addition to the dividends paid for an amount of €mil. 335 (of which €mil. 298 related to Leonardo S.p.a. that, in line with that communicated on the occasion of the 2025-2029 Industrial Plan, paid a dividend almost doubled equal to € 0.52 per share in 2025 vs € 0.28 per share in 2024).

Changes in the Group Net Debt

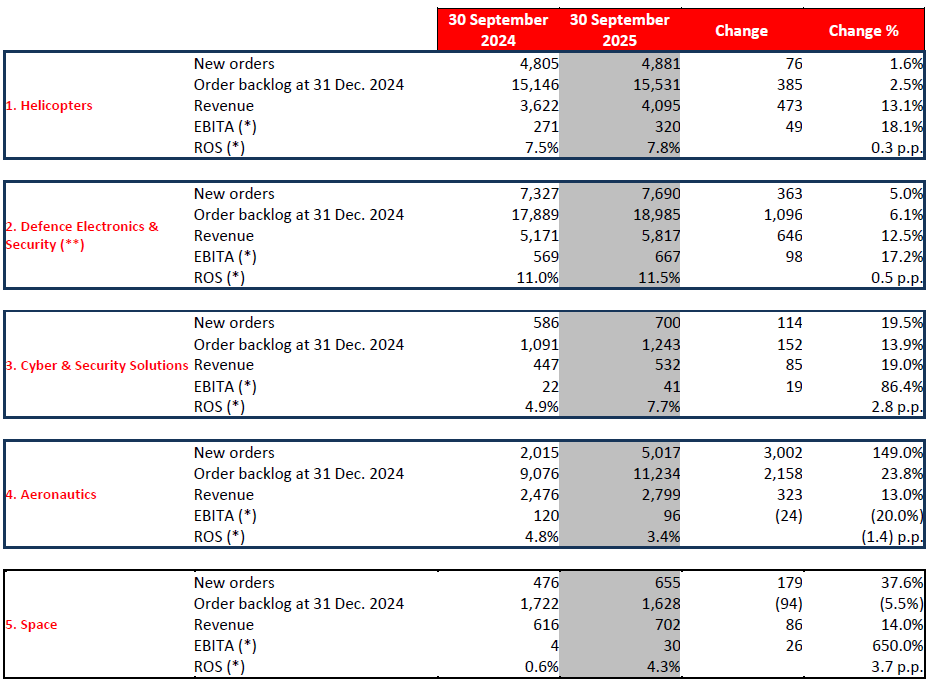

Key performance indicators by Sector

Leonardo confirms its growth path in all core Sectors of its business. The business sectors are commented on below in terms of business and financial performance:

(*) 2024 restated figure as a result of the revision of the KPI with reference to the valuation of strategic investments.

(**) 2024 figure not including the contribution from the Underwater Armaments & Systems (UAS) business (isoperimeter).