Rome, 28 July 2023 18:28

Orders € 8,691 million (+21.4%* vs € 7,161 million), Record Backlog ca. € 40 billion; book to bill of ca. 1.3x

Aerostructures continuing its gradual recovery to reach breakeven by end 2025

Group Net Debt of € 3,637 million, -24%, vs € 4,793 million 1H 2022, thanks to lower cash absorption

Cash flow improving on track, with reduced seasonality

Leonardo's Board of Directors, convened today under the Chairmanship of Stefano Pontecorvo, examined and unanimously approved 2023 first half results.

“The 2023 first half results show a clear improvement in orders, revenues, FOCF and debt. – Roberto Cingolani, Leonardo CEO and GM, stated – The results confirm solid and positive trends across the Group. Looking forward, we are starting to set up the new Industrial Plan which will be announced at the beginning of next year. The key pillars are the further strengthening and consolidation of the Core Business with a particular focus on defence products, as well as the expansion of new initiatives, with the strengthening of the fastest growing sectors, such as Space and Cybersecurity. We will also give a renewed boost to the digitalization of our entire product portfolio to further increase our competitiveness in all our domestic and international markets”.

(*) Adjusted perimeter to exclude the contribution of Global Enterprise Solutions, sold in July 2022.

1H 2023 financial results

The excellent performance already recorded by the Group already recorded in 2022 continued in the first half of 2023.

Such performance is far more significant if we compare the adjusted figures, which were restated to make the results of comparison more representative and take into account the changes in the Group’s scope of consolidation as set out below.

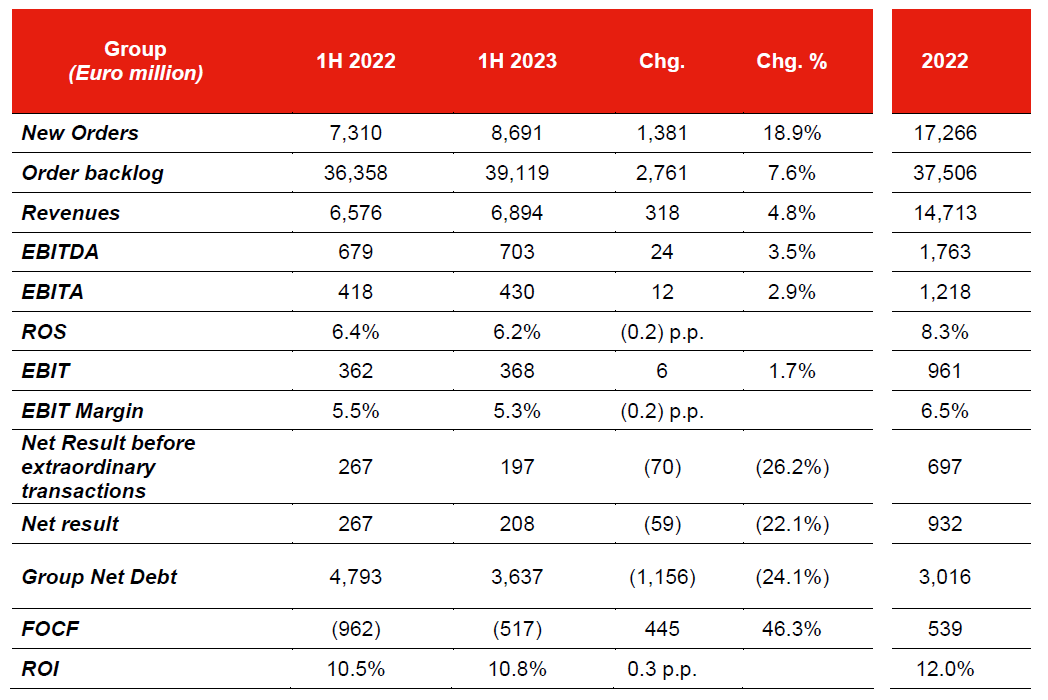

New orders recorded a substantial increase of 18.9% which went up to 21.4% compared with the adjusted figure in the first half of 2022, especially driven by the Helicopters and Electronics businesses, thus confirming the strengthening of the Group market positioning in these sectors.

Revenues were up by 4.8% (6.4% against the Adjusted figure), regarding particular in Aeronautics business thanks to a significant recovery in Aerostructures (+40% against the first half of 2022). The growth in Revenues was accompanied by a growth of EBITA of 2.9%, which appears more evident in the Adjusted figure (5.7%), and sound profitability in any and all business segments.

A marked improvement of 46% (47% against the Adjusted figure) was recorded in Free Operating Cash Flow for the half-year, with a consequent positive impact on the Group Net Debt, which decreased by 25% compared with the first six months of 2022.

The Group’s Key Performance Indicators are described below; for more details, reference should be made to the paragraph “Non-GAAP performance indicators” for definitions.

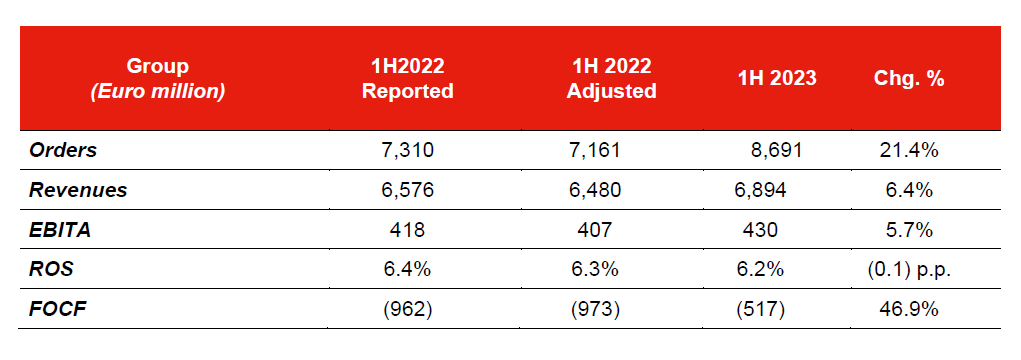

Key Performance Indicator with perimeter adjusted

For a better comparability of the Group's operating performance, we report below some Adjusted performance indicators for the comparative period, excluding the main deconsolidation transactions from the Group’s scope of consolidation (GES business which was sold in July 2022). When compared with Adjusted data, the signs of growth in the Group’s New Orders, Revenues and Operating Profit previously reported are further strengthened:

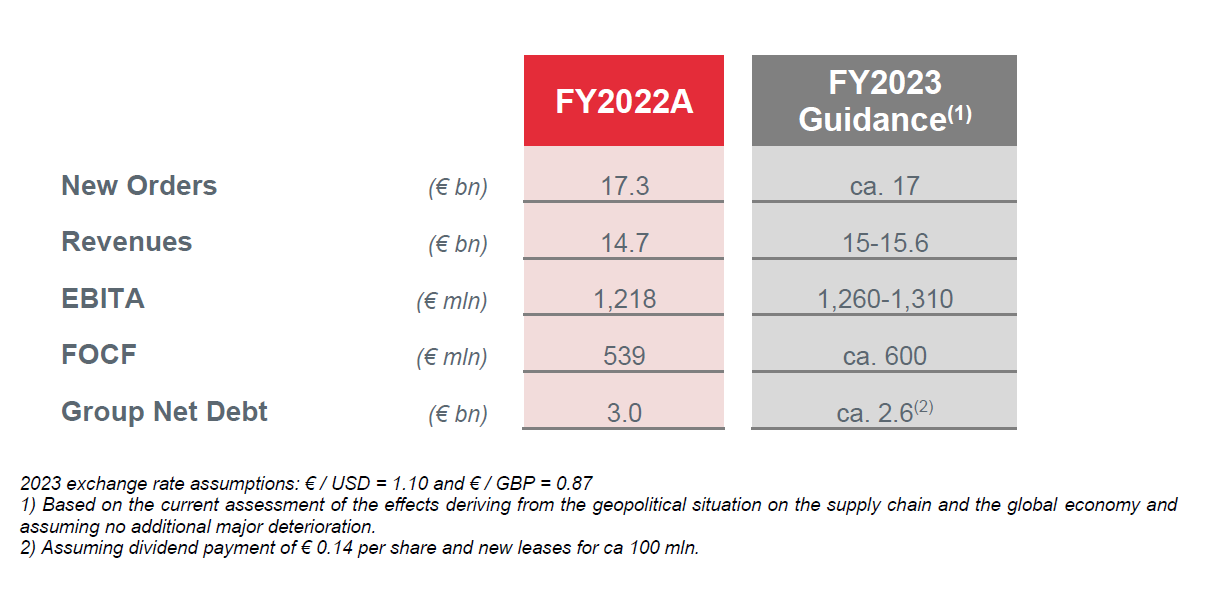

2023 Guidance

In view of the results achieved in the first half of 2023 and the expectations for the coming periods, we confirm the guidance for the entire year as drawn up when preparing the annual financial statements as at 31 December 2022.

Commercial Performance

- New Orders, amounted to EUR 8.691 million significantly increased (+18.9% on the Reported value, +21.4% on the Adjusted value) compared to the first half of 2022, in particular thanks to the excellent performance of Helicopters mainly linked to orders for the Austrian Ministry of Defence and the US Air Force, with a constant growth of orders in Defence Electronics & Security. The Order level for the half-year is equal to a book to bill (the ratio of New orders to Revenues for the period) amounting to about 1.3x

- Backlog, amounted to EUR 39,119 million ensures a coverage in terms of production higher than 2.5 years

Business Performance

- Revenues, amounted to EUR 6,894 million, showed an increase compared to the first half of 2022 (+4.8% on the Reported value, +6.4% on the Adjusted value), in all business sectors, including Aerostructures, which benefitted from resuming deliveries of B-787

- EBITA, amounted to EUR 430 million, reflected the solid performance of the Group’s business, showing an increase compared to the first half of 2022 (+2.9% on the Reported value, +5.7% on the Adjusted value), thanks to the higher volumes recorded in all business area

- EBIT, amounted to EUR 368 million, (€mil. 362 in the first half of 2022) showed growth as well, while incurring additional restructuring costs mainly due to the additions to the agreement for the early retirement of the workforce in the Corporate and Staff functions (€mil. 20), as well as the amortisation of the Purchase Price Allocation related to the acquisition of Rada, which was completed in the second half of 2022

- Net Result before extraordinary transactions, amounted to EUR 197 million, (€mil. 267 in the comparative period) reflected, on the other hand, the increase in borrowing costs, mainly linked to exchange rate operations and the effect of the non-strategic investments valued at equity, in addition to a higher impact of tax charges

- Net Result, equal to EUR 208 million (€mil. 267 in the comparative period) reflects, compared to the Net Result before extraordinary transactions, the capital gain of €mil. 11 arising from the sale of the ATM business unit on the part of Selex ES LLC

Financial performance

- Free Operating Cash Flow (FOCF), negative for EUR 517 million, improving significantly (+46.3%) compared to the figure at 30 June 2022 (negative for €mil. 962), thus confirming the path embarked on to reduce interim cash absorptions. The figure thus consolidates the positive results of the initiatives aimed at strengthening the performance of operations, of the streamlining measures and of a careful investment policy in a period of business growth and efficient financial strategy

- Group Net Debt, of EUR 3,637 million, showed a considerable reduction (approx. €bil. 1.2) against June 2022 thanks to the strengthening of the Group's cash generation. Compared to 31 December 2022 (€mil. 3,016) the figure increased mainly as a result of the FOCF performance, as well as of the payment of dividends for an amount of €mil. 82

1H 2023 Key Performance Indicator

(*) EBITDA is given by EBITA, as defined below, before amortisation and depreciation (excluding amortisation of intangible assets arising from business combinations) and impairment losses (net of those relating to goodwill or classified among “non-recurring costs”).

(**) EBITA is obtained by eliminating from EBIT the following items: any impairment in goodwill; amortisation and impairment, if any, of the portion of the purchase price allocated to intangible assets as part of business combinations, restructuring costs that are a part of defined and significant plans; other exceptional costs or income, i.e. connected to particularly significant events that are not related to the ordinary performance of the business.

(***) EBIT is obtained by adding to Income before tax and financial expenses (defined as earnings before “financial income and expense”, “share of profits (losses) of equity- accounted investees”, “income taxes” and “Profit (loss) from discontinued operations”) the Group’s share of profit in the results of its strategic investments (MBDA, GIE ATR, TAS, Telespazio and Hensoldt), reported in the “share of profits (losses) of equity-accounted investees”.

SECTOR PERFORMANCE

The Key Performance Indicators of the business Sectors are reported below while pointing out that - starting with 2022 financial statements - the Group has set out a method of representing its performance that is increasingly consistent with corporate strategies and underlying business dynamics. The performance in the sectors will therefore be represented and commented on with reference to the operating sectors of Helicopters, Defence Electronics and Security, Aircraft, Aerostructures and Space (the results at 30 June 2022 of Helicopters, Defence Electronics and Security, Aeronautics and Space were restated to facilitate the performance comparison).