Rome, 29 February 2024 18:00

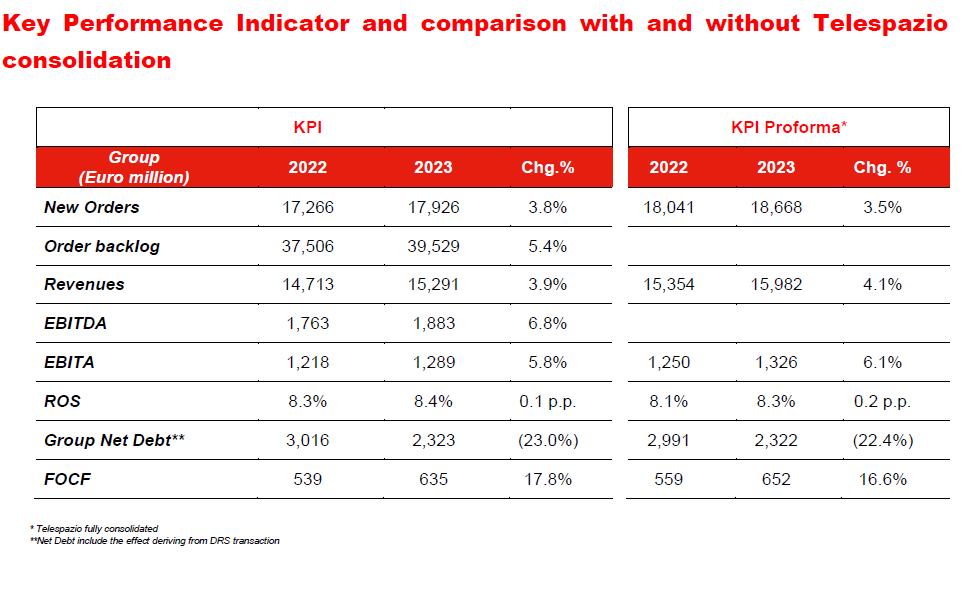

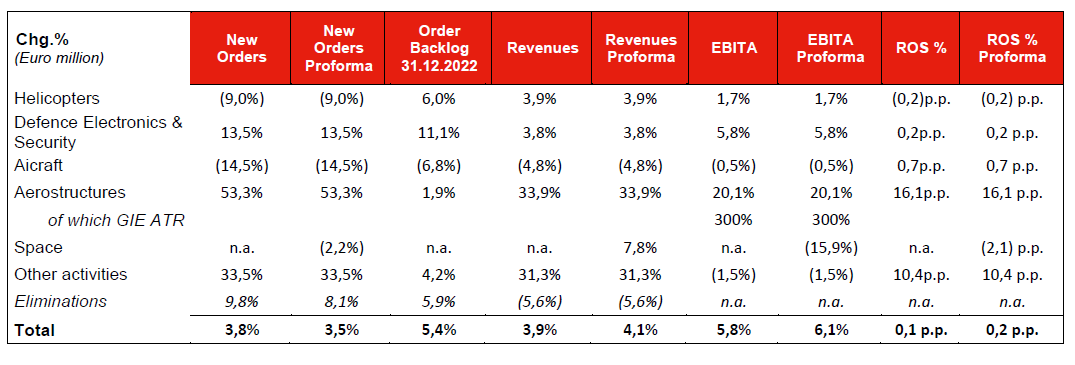

- Orders of € 17.9 bn (+3.8% vs 2022), ahead of Guidance, with a book-to-bill of 1.2x

- Revenues of € 15.3 bn (+3.9% vs 2022), in line with Guidance, reflecting growth across all divisions

- EBITA of € 1.29 bn (+5.8% vs 2022), in line with Guidance

- Free Operating Cash Flow of € 635 mln (17.8% vs 2022), ahead of Guidance, driven by topline growth and cost & investment discipline

- Group Net Debt, of EUR 2,323 mln, -23% versus EUR 3,016 million in 2022

- Progressing on strategic priorities and delivering on financial targets

- 2024-2028 Industrial Plan to be presented on 12th March

Leonardo's Board of Directors has today reviewed the preliminary full year 2023 results.

“Our strong commercial performance across our businesses, financial flexibility, cost and investment discipline. – Roberto Cingolani, CEO and GM of Leonardo, stated – are the basis of the positive results achieved by the Group in 2023”. -

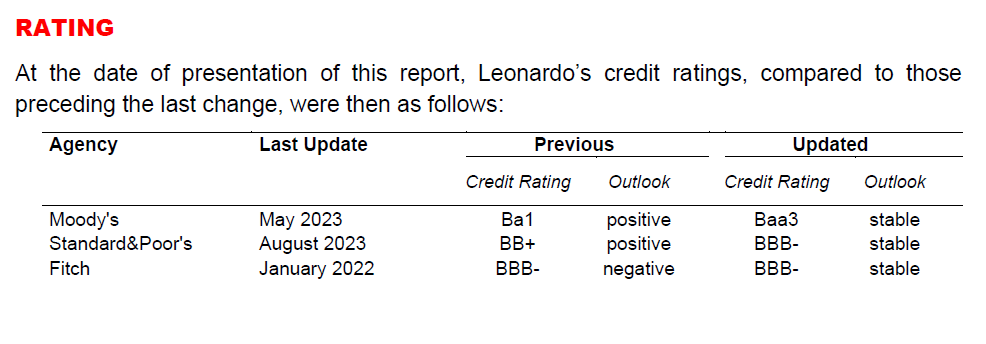

“The performances achieved are also receiving recognition from the main Credit Rating agencies and the Investment Grade rating is an example of this". – Roberto Cingolani concludes.

2023 preliminary results

Leonardo has delivered another year of strong financial performance, meeting or exceeding targets.

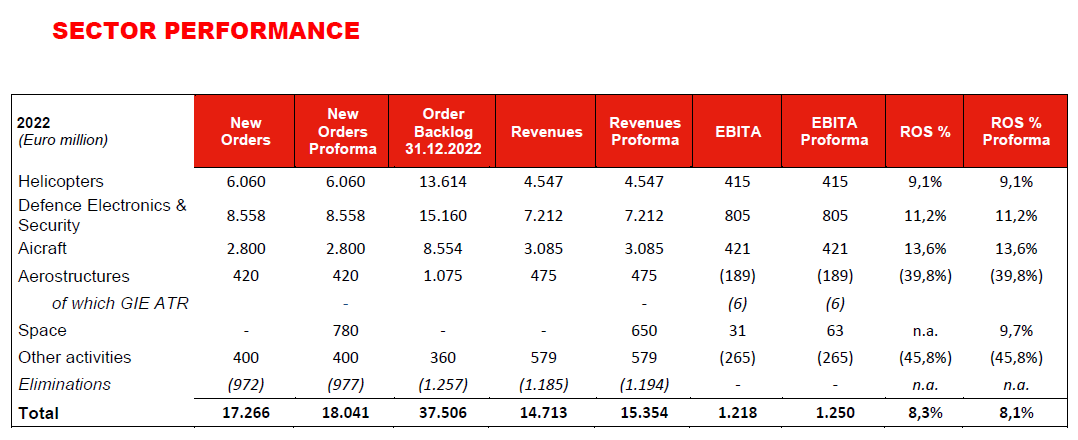

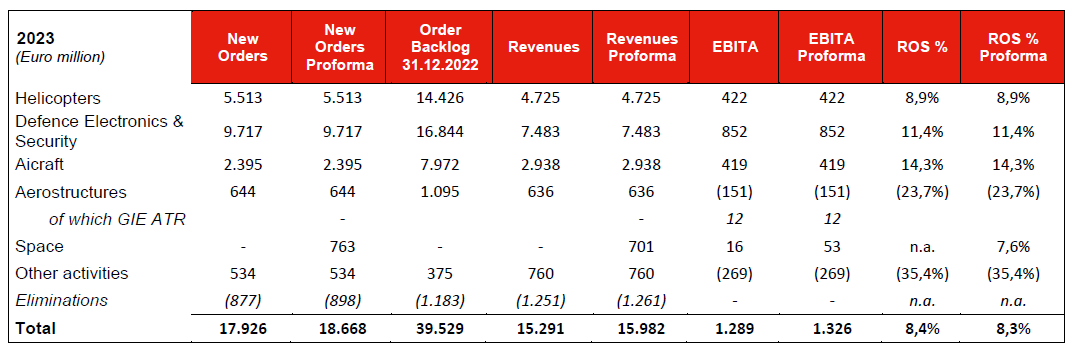

Orders show continuous and structural growth, reaching close to the level of € 18 billion (over € 18.7 billion on a pro forma basis consolidating Telespazio), with a strong performance in European Electronics. The strong growth and positive commercial trend is even more relevant considering that 2022 Orders included jumbo order for the AW149 helicopters in Poland.

Revenues are growing by 3.9% (+4.1% Proforma consolidating Telespazio), thanks also to the performance of Defense Electronics & Security and Helicopters, as well as the significant recovery of Aerostructures (+34%). Revenue growth is combined with growth in EBITA of 5.8% (+6% Proforma consolidating Telespazio).

EBITA continues to be driven by Defense Electronics and Security, with a strong contribution from the European component, and by the ongoing Aerostructures recovery, bringing ROS to 8.4%.

The financial performance is strong, with the cash flow (FOCF) recording an increase of 17.8% compared to the already material figure recorded in 2022, demonstrating the Group's ability to continue the efficiency path undertaken leading to growing cash flow generation and conversion.

Group net debt continues to decrease, with an improvement of over 23% compared to 2022, and stands at 2.3 billion euros; the significant cash generation and the proceeds deriving from the sale of the minority stake of DRS have allowed the Group to continue on the path of debt reduction.

Helicopters

The 2023 performance showed continued robust commercial performance and an increasing pace of delivery. It confirms the solidity of the Sector, showing a positive performance in line with expectations, with Revenues and EBITA growing compared to 2022 and a high level of new orders albeit lower than the previous year, which had benefited from the contract for the supply of 32 AW149 helicopters to the Polish Ministry of Defense. During the period, Deliveries of 185 new helicopters compared to the 149 registered in 2022. The reduction in Orders due to the registration of the aforementioned order for Poland in 2022 was partially offset above all by a significant growth in acquisitions in the Commercial sector demonstrating the success of the Division's products. Revenue growth was attributable to increases in dual use helicopter lines and CS&T, attenuated by the lower contribution of the NH90 Qatar program. EBITA increased in line with revenues for a flat margin year-on-year.

Defence Electronics & Security

The year showed strong commercial performance and positive growth across all sectors. The notable commercial performance led to a book to bill ratio >1 and was in all the main business areas, with increasing volumes and profitability with particular reference to the European component. Leonardo DRS recorded a level of acquisitions higher than the same period last year, and a growing level of volumes and profitability despite the unfavorable effect of the $/€ conversion exchange rate and with the different reference perimeter due to the sale of the GES business which took place at the end of July 2022. Orders recorded strong growth in all business areas, despite the aforementioned different reference perimeter. Among the main acquisitions of the period we highlight the order to complete the development and integration of the new ECRS Mk2 (European Common Radar System) radar for the Typhoon fleet of the Royal Air Force (RAF) in the UK. Revenues grew (+3.8%) in all the main business areas of the European component and in the subsidiary Leonardo DRS, despite the different reference perimeter. EBITA contribution of the business areas of the European component is growing with particular reference to the Cyber Security Division and the greater contribution of the JVs. Profitability of the Electronics Division remains solid and in line with last year despite inflationary pressure (and some supply chain disruptions). Increased result compared to last year, also for Leonardo DRS, net of the unfavorable trend in the USD/€ exchange rate with profitability remaining substantially in line.

Aircraft

The Aircraft Division confirms a strong delivery of profit and a higher level of profitability, with a decline from a commercial point of view due to the postponement of some export orders. Orders recorded a reduction in the volume mainly due to the 2022 registrations of the first design phase of the EuroMALE remotely piloted aircraft system and the order for the avionics modernization of the C-27J fleet for the AMI. Revenues were slightly lower than 2022, which had benefited from Kuwait's aircraft production ramp-up. However, the high levels of revenues for the EFA, JSF and proprietary platforms programs are confirmed. EBITA is in line with the same period of 2022, confirming the double digit in terms of ROS despite the decline in volumes.

Aerostructures

Aerostructures made further progress in the year in line with its recovery plan. The increase in deliveries follows the greater demand from OEMs, associated with the progressive improvement in the saturation of the production sites, in particular Grottaglie, confirms the continuous improvement in the performance of the Aerostructures Division supported by the recovery, even if not at pre-Covid levels, of the GIE ATR consortium. In 2023, Leonardo delivered 39 fuselage sections and 32 stabilizers for the B787 program (22 fuselages and 13 stabilizers delivered in 2022) and 31 fuselage deliveries for the ATR program (24 in 2022). GIE recorded 36 deliveries compared 25 in 2022, confirming the recovery trend in volume growth. There was a significant increase in New Orders compared with 2022 as the effects of the pandemic wind-down and new programs (Vertical and Boom) begin to ramp up. Revenues in 2023 confirms the growth in volumes due to the increase in activities due to greater preparation work on all lines. Improvement in EBITA is mainly attributable to the increase in the saturation of industrial assets (in particular Grottaglie) and the workforce with consequent recovery of profitability. Furthermore, the GIE ATR Consortium also highlights a significant increase in the number of deliveries, improving all the performances recorded in 2022.

Space

In 2023, Space recorded a decrease in EBITA compared to the previous year attributable to the significant costs linked to development activity in the manufacturing segment of the telecommunications business. The satellite services segment recorded a growing operating result compared to 2022, confirming the positive trend underway, characterized by the solid performance of the production volumes of the Lob Satellite Systems and Operations, the better performance of the Lob GeoInformation, and the significant recovery in orders in the Satcom business. The growth in the operating result offsets the impact of the costs associated with the signing of the early retirement agreement pursuant to art. 4 of the so-called Fornero Law.

The officer in charge of the company’s financial reporting, Alessandra Genco, hereby declares, in accordance with the provisions of Article 154-bis, paragraph 2, of the Consolidated Law on Finance, that the accounting information included in this press release corresponds to the accounting records, books and supporting documentation.

The approval of the Leonardo’s draft annual financial statements and consolidated financial statements as of December 31, 2023 is scheduled for March 11, 2024.

The data reported in this document do have not completed the audit process (pursuant to Legislative Decree 39/2010 and Legislative Decree 254/2016) by the Independent Auditors and are therefore to be considered "unaudited". Furthermore, the activities pursuant to Law 262/2005 carried out on behalf of the officer in charge of the company’s financial reporting on the Corporate Accounting Information Control Model are still ongoing and not completed.

As part of the annual assessment of the independence requirements of the Directors, at today's meeting the Board of Directors verified that the independence requirements provided for by law and by the Corporate Governance Code remain for the non-executive Directors Trifone Altieri, Giancarlo Ghislanzoni, Enrica Giorgetti, Dominique Levy, Francesco Macrì, Cristina Manara, Silvia Stefini, Elena Vasco and Steven Wood. The Board also verified the non-independence of Director Marcello Sala, by virtue of his role and his employment relationship with the Ministry of Economy and Finance.

With reference to the Chairman, Amb. Stefano Pontecorvo – without prejudice to the existence of the requirement of independence pursuant to the “Testo Unico della Finanza” – taking into account the concrete exercise of the powers conferred on him in the field of “Finanza agevolata” and in light of the supervening finalization of the Company's organizational structure, the Board of Directors has ascertained the qualification of the latter as Executive Chairman and, therefore, he is not an independent Director pursuant to the Corporate Governance Code.

The Board of Statutory Auditors verified the correct application of the criteria and procedures for assessing the independence requirements set out in the Corporate Governance Code.