12 March 2024 09:00 Inside Information

Transformation of the Business Model: from Defence to Security with a Technological Evolution that involves Massive Digitalization, Domain Interoperability and Artificial Intelligence.

- Strengthening the core business across Defence Electronics, Helicopters and Aircraft, confirming Aerostructures recovery, and leveraging opportunities in Cyber and Space

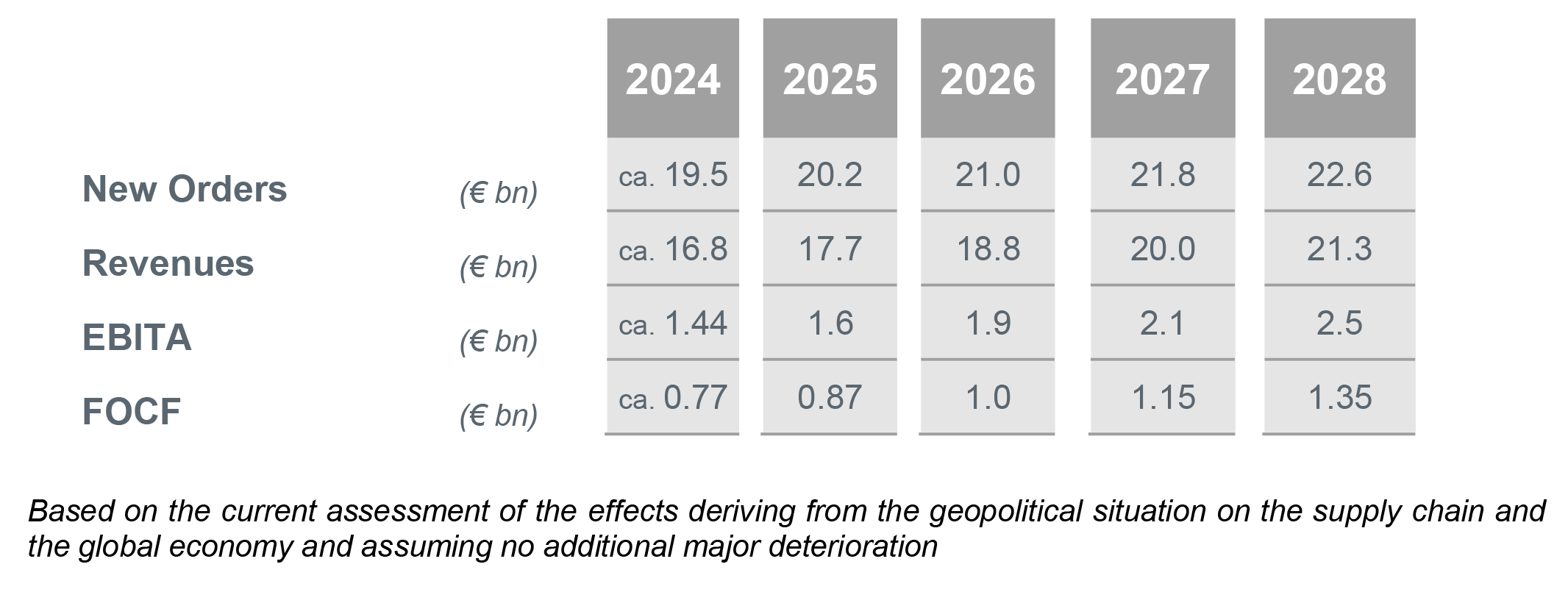

- Cumulative orders (€ 105 billion) with CAGR of 4%

- Cumulative revenues (€ 95 billion) with CAGR of 6% between 2024-28

- 10% profitability in 2026 and 11.5% in 2028

- FOCF at € 1 billion in 2026, € 1.35 billion by Plan end, doubling vs 2023

- Sustainability as a crucial pillar for developing Leonardo and the supply chain: >70% of new tenders awarded including ESG criteria

- Disciplined capital allocation strategy supporting growth

- Proposed to double dividend at € 0.28 per share

Rome, 12/03/2024 – Leonardo's Board of Directors, chaired by Stefano Pontecorvo, has unanimously approved the 2024-2028 Industrial Plan.

Leonardo presents the details of its Industrial Plan to the financial community, including 2024 Guidance and medium-term financial targets.

"The Industrial Plan has defined a strategy for unlocking the business growth potential of Leonardo delivering stronger top-line growth, double digit profitability by 2026 and doubled FOCF by the end of the Plan. This will be achieved through, a massive digitalization and rationalization of products and services, Group-wide efficiencies and cost reduction initiativest – targeting € 1.8 billion gross savings over the Plan time span – and inorganic growth” – Roberto Cingolani CEO and GM stated.

“The world geopolitical scenario calls for a new Global Security paradigm, where weaim to play a proactive role in the evolution of the European Defence sector.” Cingolani added

2024 – 2028 Industrial Plan: strengthening our core and pave the way to the future of Leonardo

Over the Industrial Plan period, Leonardo aims to transform into a global technology based Aerospace & Defence solutions provider.

This will be achieved through two strategic pillars:

- Strengthening the core business

- Rationalizing the business and product portfolio of the core business

- Improving competitiveness through digitalization and innovation while reducing costs

- Focused R&D expenditure on innovative technologies, including Artificial Intelligence, Cloud and Supercomputing technologies

- Forging international alliances and strategic partnerships

- Leonardo of the future: addressing opportunities in the broader security challenge

- Build a company working in a cross-divisional multi-domain environment powered by digitalization and Artificial Intelligence

- Enhance Cyber capabilities on Defense, Space, and National Strategic Organization

- Create a Space Division to consolidate all related activities and evolve the Space Alliance to focus on high-value segments

The Industrial Plan is based on three main drivers:

- Innovation and organic growth through digitalization and innovation

The first driver stems from the strengthening of the core business of Defence based on a massive use of digitalisation and a focus of R&D activities on areas and sectors with high value-added (Digital continuum, Cloud, Computing power, Broadband resilient communication, Security by design, Artificial Intelligence).

The progressive and extensive digitalization (use of satellite communications as well as drones) has radically changed schemes and perspectives in international scenarios, introducing a new concept of global security that goes beyond the traditional one of Defense. It is a change - not only in the approach - that involves important efforts to adapt technology.

The Digital Continuum will enable Multi-Domain technologies to orchestrate military activities across all operating domains (Land, Air, Maritime and Space)

- Efficiency boost through product and portfolio rationalization and group wide savings

Targeting greater efficiency will be based on a rationalization of the product portfolio, the optimization of engineering & manufacturing processes, thanks to an increase in digitalization, and the undertaking of a major optimization of group-wide procurement and corporate costs reduction.

The results of these actions are expected to lead to a total cumulative € 1.8 billion of Group gross savings over the plan horizon, starting with € 150 million in 2024 rising to € 590 million per annum in 2028. Expected growth in Plan KPIs includes the effect of the abovementioned savings.

- International alliances and inorganic growth

In addition to these two drivers, inorganic growth, not included in the current Plan, will be a further line of expansion of the alliance policy and possible targeted bolt-on M&A transactions in specific areas with high margins. Defence is no longer regarding individual national borders, but has become an international and 'Global Security' scenario, and the strategy of alliances is one of the possible answers.

The Group will play a proactive role in the evolution of the European Defence industry.

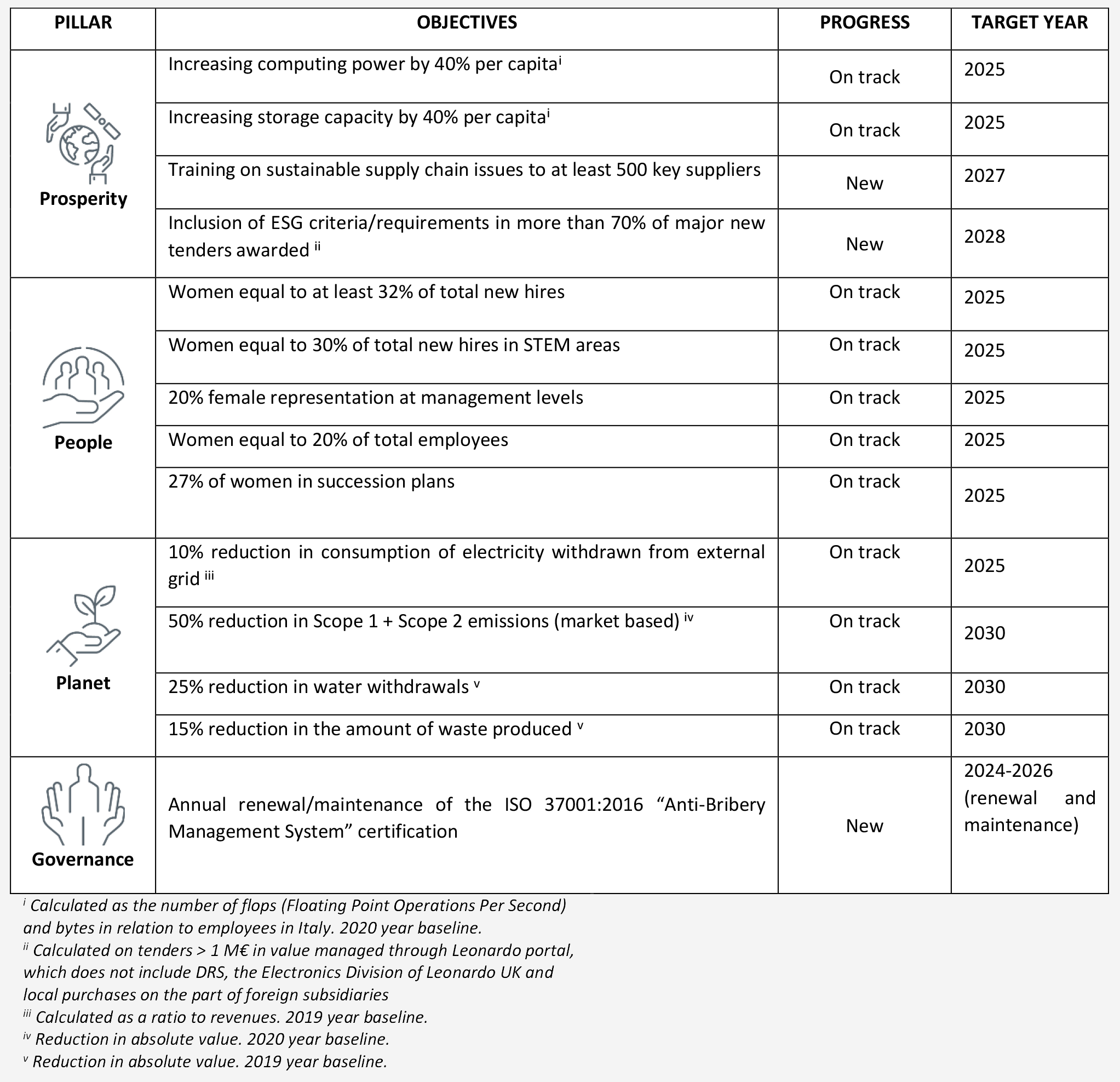

2024-2028 SUSTAINABILITY PLAN

Sustainability is one of the enabling factors of Leonardo’s Industrial Plan and is integrated along the entire value chain. Consistently, this approach is reflected by the new Group 2024-2028 Sustainability Plan. It aims to achieve sustainability targets across the four Prosperity, People, Planet and Governance pillars by focusing on: strengthening sustainability of the supply chain, with the aim of including ESG criteria in at least 70% of new major purchase tenders by 2028; promoting a diversity, equity and inclusion culture to reinforce women’s contribution within the company in terms of hires and female presence in leadership positions; confirming its decarbonization path through the reduction of market-based Scope 1 and 2 emissions by 50% by 2030, in line with the commitment towards the Science-Based Targets Initiative.

The new five-year Sustainability Plan, integrated with the Group Industrial and Strategic Plan, consists of 100 projects aiming to achieve Group targets and priorities, with over half of the planned budget focused on developing sustainable products and solutions and with a growing contribution by Space and Cyber businesses. Indeed, with the new Plan, Leonardo enhances its impact on sustainable development of planet and society through technologies for citizen and infrastructure security and climate protection, such as global monitoring from in-orbit services, advanced virtual training systems for helicopters and aircraft, and new fuels (SAF). Among the main commitment areas, the Plan will also focus on digitalization as sustainability enabler, with examples of smart factory based on the NEMESI model and with the upgrade of Davinci-1 supercomputer, decarbonization and efficient use of natural resources, sustainable supply chain and social impact.

Leonardo’s sustainability targets

DIVISIONAL HIGHLIGHTS

The plan will focus on capabilities across each of the businesses. Across divisions, Leonardo’s objective is to strengthen core business and pave the way to the broader security challenge.

Electronics: Leonardo aims to become a global player in Defence Electronics through increased competitiveness, investment in technology, product rationalization focusing on core offering, and leveraging its international partnerships.

During the Plan’s period, Electronics is expected to grow orders, revenues and EBITA at 3%, 8% and 13% respectively.

Helicopters: Become a global civil leader and military key player by accelerating order conversion and boost product development to achieve a leading position in tilt-rotor technology considered as most viable and mature technology by leading military institutions.

During the Plan’s period, orders, revenues and EBITA in Helicopters are expected to grow at 2%, 6% and 8% respectively.

Aircrafts: Secure key positions for the division in leading international cooperative programmes sustaining its high profitability and increasing competitiveness through an upgraded product portfolio.

During the Plan’s period, orders, revenues and EBITA in Aircrafts are expected to grow at 11%, 7% and 4% respectively.

Aerostructures: Become a profitable supplier, leveraging on its operational excellence and market recovery, and scale up through strategic partnerships.

During the Plan’s period, orders and revenues in Aerostructures are expected to grow at 16% and 17% respectively, with EBITA breakeven by end 2025.

Cyber: Leverage the accelerating demand opportunities to scale Cyber operations through organic and inorganic growth, acquiring distinctive competencies with the aim of become a key European player.

During the Plan’s period, orders, revenues and EBITA in Cyber are expected to grow at 16%, 13% and 33% respectively.

Space: Consolidate the Space activities into a new division and leverage existing capabilities to become a key European leader in high-value segments. Organic growth to be complimented with inorganic levers.

During the Plan’s period, orders, revenues and EBITA in Space are expected to grow at 10%, 11% and 16% respectively.

FINANCIAL HIGHLIGHTS

The Group key targets of the Industrial Plan over the next 5 years (2024-2028) are:

ORDERS

- Cumulative new order intake of € 105 billion

- Order growth anchored on portfolio of products and solutions responding to evolving customer needs

- Supportive market backdrop driving domestic and export orders, without concentration of exposure to single country/customer

- Book to bill consistently > 1, growing backlog from € ~40 bn to € ~50 bn at the end of the Plan

REVENUES

- 6% expected CAGR through backlog delivery and new wins

- Balanced growth across businesses with synergic effect between platforms and sensors/systems operating in a multi-domain environment

- Proven track record of delivering growth successfully managing exogenous challenges in the supply chain

EBITA

- Profitability growing at 2x revenue growth rate

- Operating leverage, stringent program management and group wide efficiency plan supporting 10% target in 2026 and 11.5% in 2028

- Advanced technological offering and portfolio refocus resulting in higher margins on projects

FOCF

- Doubling cashflows derived from higher EBITA, while investing in key programs representing the future product portfolio (e.g., AW609, AW09, trainers, advanced sensors, and systems) and boosting digital capabilities and infrastructure

- Significant step up in cash taxes from 2027 onwards reflecting full utilization of NOLs by 2026

- Disciplined working capital build to support business growth

DISCIPLINED FINANCIAL STRATEGY

- Full commitment on preserving Investment Grade status

- M&A financing in line with prudent financial strategy

- € 5 billion of cash generation over the 5 years of the Plan

CAPITAL ALLOCATION

The Group is putting in place a disciplined capital allocation strategy supporting growth and shareholder returns:

- Debt repayment aimed to maintaining a solid investment grade with the target of pay down ca. 50% of maturing debt while preserving liquidity

- Investing in growth initiatives:

Capital expenditures in areas where the Internal Rate of Return (IRR) exceeds our Weighted Average Cost of Capital (WACC) and hurdle rate, projecting estimated net investment spend to be at an average € 750-850 million per year

Additionally Leonardo is actively pursuing M&A activities focussed on strategic area of growth (Cyber and Space), not exceeding 15%-20% of Divisional Turnover

- Committed to return cash to shareholders’ establishing a pay-out ratio to be increased substantially in the Plan

DIVIDEND PROPOSAL

Leonardo's Board of Directors has resolved to propose to the Shareholders' Meeting the distribution of a dividend of 0.28 euro, from the profit of the year 2023, gross of any withholding taxes. This dividend would be payable as of June 26, 2024, with ex-dividend date (coupon no. 14) on June 24, 2024 and record date (i.e. the date of entitlement to the dividend payment pursuant to art. 83-terdecies of TUF) June 25, 2024. The above with reference to each share of common stock that will be outstanding on the ex-dividend date, excluding the own shares held on that date, without prejudice to the regime of those that will be effectively assigned, pursuant to the current incentive plans, during the current year.

WEBCAST DETAILS

Leonardo presents its Industrial Plan today at 11am CET in a hybrid event at its Electronics facility in Rome and via webcast. Webcast details are available at our Investor Relations website (https://www.leonardo.com/en/investors/results-and-reports) where you can download the slide presentation and submit questions during the Q&A session. The event is expected to last 3 hours. A replay will be made available after the event.

SAFE HARBOR STATEMENT

Some of the statements included in this document are not historical facts but rather statements of future expectations, also related to future economic and financial performance, to be considered forward-looking statements. These forward-looking statements are based on Company’s views and assumptions as of the date of the statements and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Given these uncertainties, you should not rely on forward-looking statements.

The following factors could affect our forward-looking statements: the ability to obtain or the timing of obtaining future government awards; the availability of government funding and customer requirements both domestically and internationally; changes in government or customer priorities due to programme reviews or revisions to strategic objectives (including changes in priorities to respond to terrorist threats or to improve homeland security); difficulties in developing and producing operationally advanced technology systems; the competitive environment; economic business and political conditions domestically and internationally; programme performance and the timing of contract payments; the timing and customer acceptance of product deliveries and launches; our ability to achieve or realise savings for our customers or ourselves through our global cost-cutting programme and other financial management programmes; and the outcome of contingencies (including completion of any acquisitions and divestitures, litigation and environmental remediation efforts).

These are only some of the numerous factors that may affect the forward-looking statements contained in this document.

The Company undertakes no obligation to revise or update forward-looking statements as a result of new information since these statements may no longer be accurate or timely.