Rome 03 May 2023 18:07

STRONG COMMERCIAL PERFORMANCE

- Growing backlog at € 39.1 billion, equal to more than 2.5 years of production

- Book to Bill at 1.6x

SOLID OPERATING RESULT

- Strong performance in our Divisions

- Gradual recovery of Aerostructures

- Slower start to the year for strategic JVs, as expected, with a contribution down by 21 million vs 1Q2022

- ROS 3.9%(**) in line with 1Q 2022 (***)

INCREASED FINANCIAL STRENGTH

- Group Net Debt down of € 1.1 billion vs 1Q2022, thanks to the strengthening of the Group's cash generation

Leonardo's Board of Directors, convened today under the Chairmanship of Luciano Carta, examined and unanimously approved first quarter 2023 results.

“1Q 2023 commercial and financial performance showed a good start to the year - Alessandro Profumo, Leonardo CEO, stated – in line with expectations. Our very positive commercial performance, programme delivery and growing Top-Line are accompanied by a financial performance showing a strong and continued FOCF improvement and further steps forward in the path of debt reduction. In the first quarter we again demonstrated our competitive strength in our main defence and governmental business and the continuing performance improvement in Aerostructures. The Group is solid and sustainable in the long term, in a good position to capture best growth opportunities”.

"I’m also proud to say – Alessandro Profumo concludes – that Moody’s has just upgraded Leonardo to Investment Grade recognizing a strong execution through the pandemic, the deleveraging track record, solid growth prospects in Defence activities, in light of a tense geopolitical context, and conservative financial policies with a commitment to further delever the balance sheet”.

(*) Adjusted perimeter to exclude the contribution of Global Enterprise Solutions and including the contribution of Hensoldt in 1Q 2022 that was not included due to financial calendar misalignment

(**) Adjusted perimeter to exclude the contribution of strategic JVs and Hensoldt.

(***) Adjusted perimeter to exclude the effect of Global Enterprise Solutions, strategic JVs and Hensoldt.

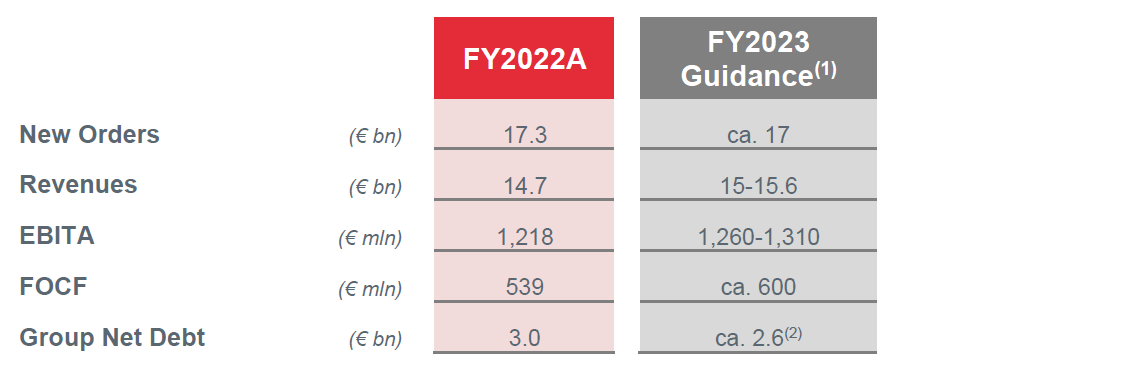

2023 Guidance

In view of the results achieved in the first quarter of 2023 and the expectations for the coming periods, we confirm the guidance for the entire year as drawn up when preparing the annual financial statements as at 31 December 2022.

2023 exchange rate assumptions: € / USD = 1.10 and € / GBP = 0.87

1) Based on the current assessment of the effects deriving from the geopolitical situation on the supply chain and the global economy and assuming no additional major deterioration.

2) Assuming dividend payment of € 0.14 per share and new leases for ca 100 mln.

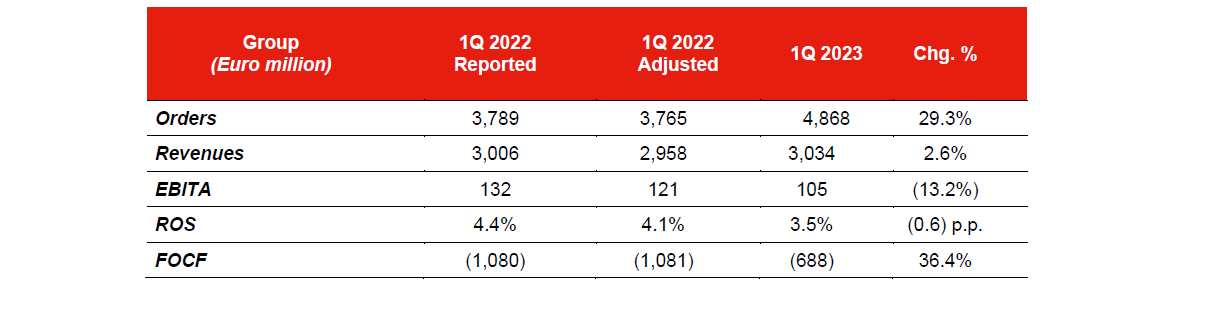

Key Performance Indicator with perimeter adjusted

The figures for the first quarter of 2022 shown above included the contribution of the GES business, which was sold in July 2022, and they did not include the Hensoldt(*) result for the quarter. For a better comparability of the Group's operating performance which, vice versa, in 2023 does not include the contribution of the GES business but includes the results for the first quarter of Hensoldt, we report below some adjusted performance indicators for the comparative period:

(*) The investment in Hensoldt was acquired in January 2022. However, due to the different financial calendars, the Group’s results for the first quarter of 2022 did not include yet the Hensoldt contribution.

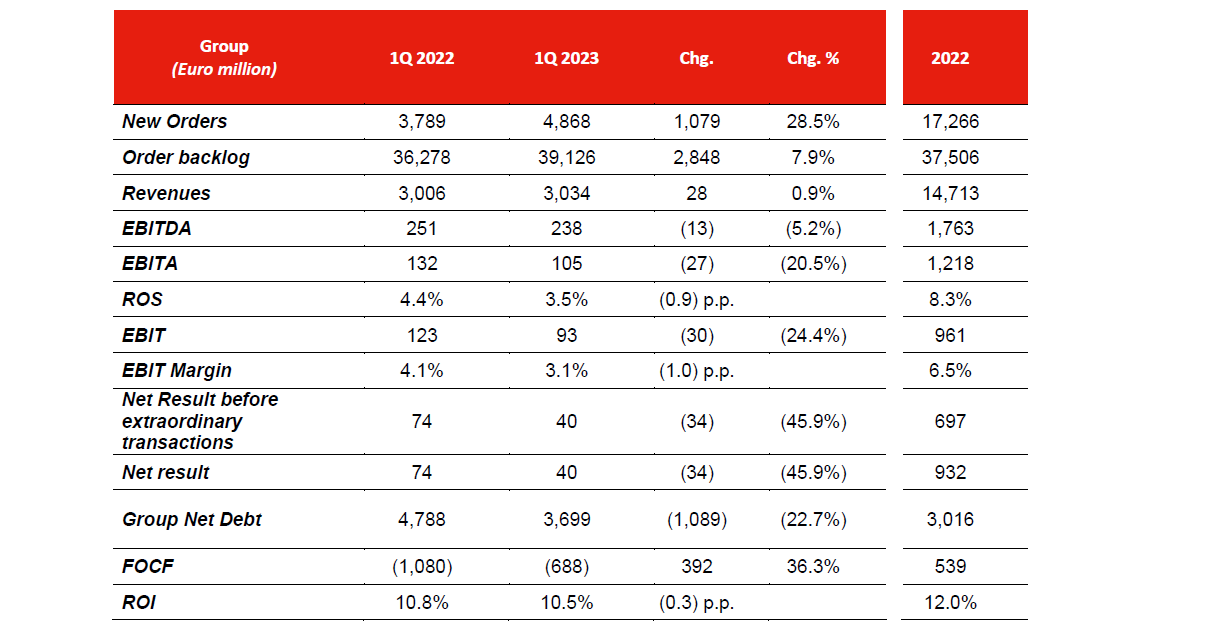

Commercial Performance

- New Orders, amounted to EUR 4,868 million significantly increased (+28.5%, +29.3 on the Adjusted value) compared to the first quarter of 2022, in particular thanks to the excellent performance of Helicopters mainly linked to orders of no. 18 AW 169 helicopters for the Austrian Ministry of Defence and no. 13 MH 139 helicopters for the US Air Force, with a constant growth of orders in Defence Electronics & Security. The order level for the quarter is equal to a book to bill (the ratio of New orders and Revenues for the period) amounting to about 1.6

- Backlog, amounted to EUR 39,126 million ensures a coverage in terms of production higher than 2.5 years

Business Performance

- Revenues, amounted to EUR 3,034 million, in line with those of the first quarter of 2022 for all the business sectors (+2.6% on the Adjusted value), with an increase in Defence Electronics & Security and a slight increase in Aerostructures

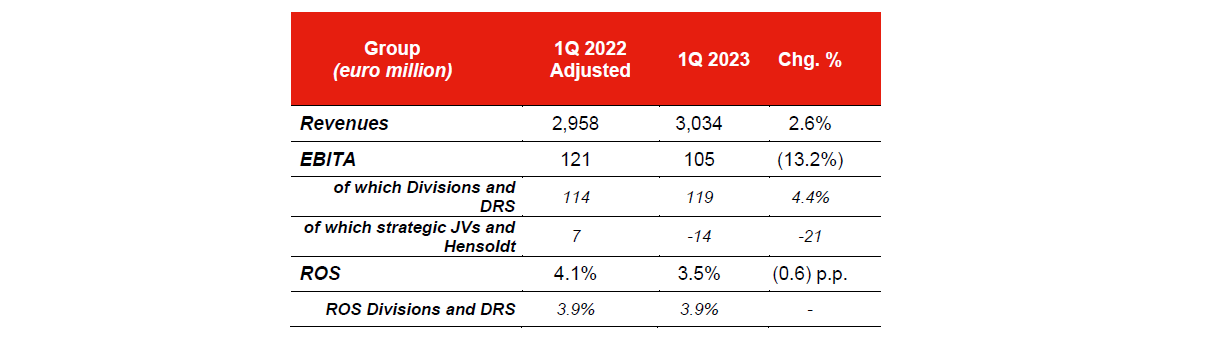

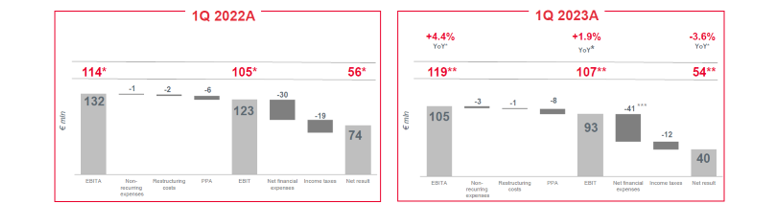

- EBITA, amounted to EUR 105 million, reflected the solid performance of the Group’s businesses and was also affected by the performance of strategic investments which, in the period, posted a negative result of €mil. 14 (positive €mil. 7 in the Adjusted value of first quarter of 2022). The Group's industrial performance – excluding the contribution of the strategic investments – shows an increase of about 4% compared with Adjusted value of first quarter of 2022)

We report below EBITA adjusted performance for the comparative period excluding the contribution of GES, Hensoldt and strategic-investment:

- EBIT, amounted to EUR 93 million, (€mil. 123 in the first quarter of 2022) was affected by the EBITA performance and the amortization of the Purchase Price Allocation related to the acquisition of Rada, finalized in 2022

- Net Result before extraordinary transactions, amounted to EUR 40 million, (€mil. 74 in the comparative period), equal to the Net Result, reflected compared to the first quarter of 2022 the performance of non-strategic investments valued at equity

- Net Result excluding the EBITA contribution of GES, Hensoldt and strategic JVs (internal estimates), equal to EUR 54 million (€mil. 56 in the comparative period)

(*) Excluding the contribution of Global Enterprise Solutions, Hensoldt and Strategic JVs

(**) Excluding the contribution of Hensoldt and Strategic JVs

(***) Reflecting the performance of equity holdings

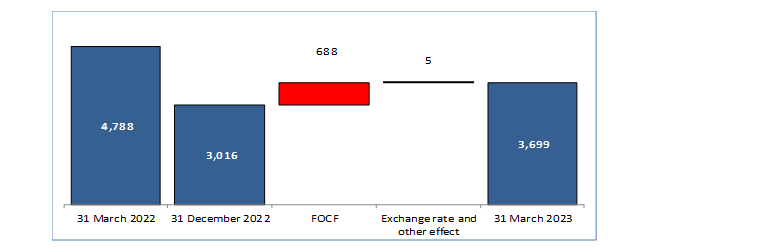

Financial performance

- Free Operating Cash Flow (FOCF), negative for EUR 688 million, showed a significant improvement (+36.3%) compared to the first quarter of 2022 (negative for €mil. 1,080). The figure consolidates the positive results of the initiatives aimed at strengthening the performance of operations, streamlining and making working capital more efficient, and of a careful investment policy in a period of business growth and efficient financial strategy. The expected positive trend towards improvement however confirmed the usual interim trend that is characterised by significant cash absorptions in the first part of the year

- Group Net Debt, of EUR 3,699 million, showed a considerable reduction of approx. €bil. 1.1 against March 2022 thanks to the strengthening of the Group's cash generation. Compared to 31 December 2022 (€mil. 3,016) the figure increased mainly as a result of the abovementioned usual FOCF performance

1Q 2023 financial results

The good commercial performance of the Group already recorded in 2022 continued in the first three months of 2023.

New orders significantly increased, specifically with the contribution of the helicopter sector, thus confirming the strengthening of the Group market positioning.

Revenues are essentially in line with those of the first quarter of 2022, showing signs of recovery in the Aerostructures sector as well.

Solid operating profitability of the business segments, with a lower contribution of the strategic investments.

A marked improvement of over 36% in cash flow for the quarter, with a consequent positive impact on the Group Net Debt.

1Q 2023 Key Performance Indicator

(*) EBITDA is given by EBITA, as defined below, before amortisation and depreciation (excluding amortisation of intangible assets arising from business combinations) and impairment losses (net of those relating to goodwill or classified among “non-recurring costs”).

(**) EBITA is obtained by eliminating from EBIT the following items: any impairment in goodwill; amortisation and impairment, if any, of the portion of the purchase price allocated to intangible assets as part of business combinations, restructuring costs that are a part of defined and significant plans; other exceptional costs or income, i.e. connected to particularly significant events that are not related to the ordinary performance of the business.

(***) EBIT is obtained by adding to Income before tax and financial expenses (defined as earnings before “financial income and expense”, “share of profits (losses) of equity- accounted investees”, “income taxes” and “Profit (loss) from discontinued operations”) the Group’s share of profit in the results of its strategic investments (MBDA, GIE ATR, TAS, Telespazio and Hensoldt), reported in the “share of profits (losses) of equity-accounted investees”.