Rome, 07 May 2024 18:19

- Backlog at record level >€ 43 billion

- Book-to-bill at 1.6x, reflecting strong commercial momentum

- Growth reflects strong delivery of backlog

- EBITA improvement driven by growing Electronics and Helicopters and efficiency measures

- Efficiency boost: plan on track to achieve full year target

- Continuous improvement of FOCF, reducing cash absorption

- Group Net Debt of € 2,931 million (-20.7%1)

* - vs 1Q23 pro-forma

Leonardo's Board of Directors, convened today under the Chairmanship of Stefano Pontecorvo, examined and unanimously approved the results for the first quarter 2024.

“We are fully focused on executing the Industrial Plan. The consolidation of the defence core business progresses very well thanks to the acceleration of the digitalization processes, creating new revenue streams and generating cost efficiencies, embedding AI and Digital Twin in all product catalogues and working on the Digital Continuum of the Armed Forces.” – Roberto Cingolani, CEO and GM of Leonardo, stated

“The future activities are shaped by the reorganization and governance changes creating the new Space Division, boosting Cyber Security activities and developing a strategy to leverage Generative AI and multidomain capabilities across all Leonardo platforms. The efficiency and saving plan is fully in place and it is on track to achieve full year targets. Finally, for the inorganic growth of the Plan, we are continuing to strengthen international alliances taking an active role in promoting a European Defence Framework. All of these will allow us to deliver growth, higher profitability and better cash conversion.” – Roberto Cingolani added.

1Q 2024 Results

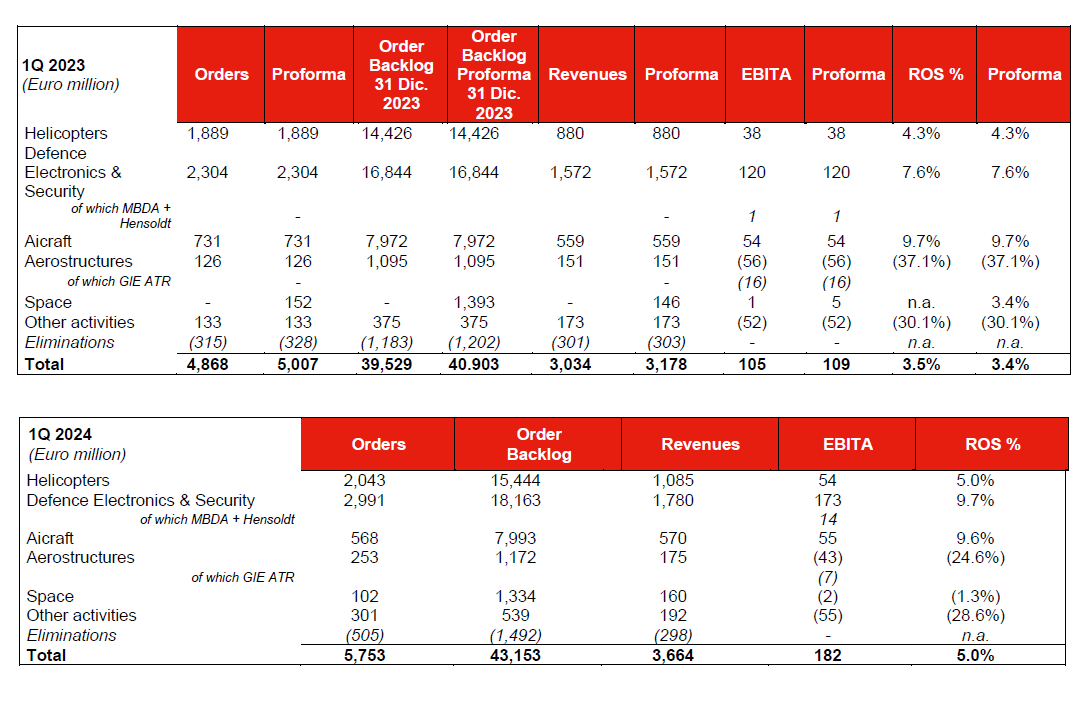

The excellent performance already recorded by the Group in 2023 continued in the first three months of 2024, with a solid profitability in all the business segments, showing a further significant growth compared to the prior period. In order to make the Group's operating performance more comparable, the indicators for the comparative period are also provided on a pro-forma basis, including the contribution of the Telespazio Group, consolidated on a line-by-line basis starting from 1 January 2024.

New orders sharply increased by 18.2% (+14.9% compared to the pro-forma figure of March 2023), specifically driven by the European component of the Defence Electronics & Security business.

Revenues increased by 20.8% (+15.3% compared to the pro-forma figure), mainly thanks to the performance of the Defence Electronics & Security and Helicopters sectors. The growth of revenues is accompanied by a significant increase in EBITA of 73.3% (+67.0% compared to the pro-forma figure), bringing the ROS for the period to 5% (3.5% at 31 March 2023).

Free Operating Cash Flow for the period also improved by 9.7% (11.5% compared to the pro-forma figure), demonstrating the Group’s ability to keep on the path to strengthen cash generation it has embarked on, though being affected by the usual interim trend that is characterised by cash absorptions in the first part of the year. The FOCF performance results in a consequent positive impact on the Group's net debt, which decreased by approximately 21% compared to the comparative period, including also the effect of the Leonardo DRS stake monetization.

Key Performance Indicator

The KPIs for the period and the main changes in the Group's performance are shown below.

The Key Performance Indicators for the comparative period are provided also on a pro-forma basis, including the effects of the line-by-line consolidation of Telespazio including change % vs pro-forma:

(*) EBITDA is given by EBITA, as defined below, before amortisation and depreciation (excluding amortisation of intangible assets arising from business combinations) and impairment losses (net of those relating to goodwill or classified among “non-recurring costs”).

(**) EBITA is obtained by eliminating from EBIT the following items: any impairment in goodwill; amortisation and impairment, if any, of the portion of the purchase price allocated to intangible assets as part of business combinations, restructuring costs that are a part of defined and significant plans; other exceptional costs or income, i.e. connected to particularly significant events that are not related to the ordinary performance of the business.

(***) EBIT is obtained by adding to Income before tax and financial expenses (defined as earnings before “financial income and expense”, “share of profits (losses) of equity- accounted investees”, “income taxes” and “Profit (loss) from discontinued operations”) the Group’s share of profit in the results of its strategic investments (MBDA, GIE ATR, TAS, and Hensoldt), reported in the “share of profits (losses) of equity-accounted investees”.

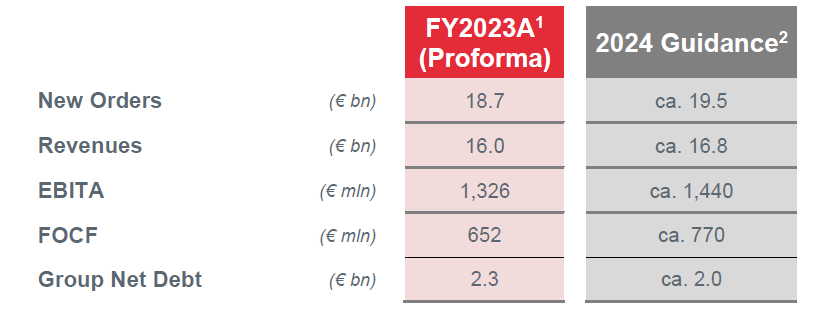

2024 GUIDANCE

According to the First Quarter 2024 results and the expectations for the coming quarters, we confirms full year 2024 Guidance as disclosed in March 2024.

Below is the summary table:

Exchange rate assumptions: €/USD= 1.15 and €/GBP= 0.89

1 The values shown for the year 2023 enhance the full consolidation of Telespazio, operational from 2024

2 Based on the current assessment of the effects deriving from the geopolitical situation on the supply chain and the global economy and assuming no additional major deterioration

Commercial Performance

- New Orders, amounted to EUR 5,753 million significantly increasing (+18.2%, +14.9% on the pro-forma figure) compared to the first three months of 2023, thanks to the important contribution of the Defence Electronics and Security sector, in all the business areas of its European component, to the contribution of Helicopters and also to the improvement of Aerostructures (+101% compared to the prior period). The level of Orders for the period is equal to a book to bill (the ratio of New orders to Revenues for the period) of about 1.6

- Backlog, amounted to EUR 43,153 million ensuring a coverage in terms of production exceeding 2.5 years

Economic Performance

- Revenues, amounted to EUR 3.664 million increased compared to the first three months of 2023 (+20.8%, +15.3% on the pro-forma figures) in all business sectors. The contribution of the Defence Electronics and Security and Helicopters sectors was particularly important

- EBITA, amounted to EUR 182 million, reflects the solid performance of the Group’s businesses, showing a significant increase compared to the first three months of 2023 (+73.3%, +67.0% on the pro-forma figure) in almost all sectors. The period was particularly affected by the performance of the Defence Electronics and Security and Helicopters sectors, in addition to the performance of the Aerostructures which showed a minor loss compared to the comparative period, confirming the improvement path undertaken. On the contrary, the Space sector was affected by the expected difficulties in the manufacturing segment.

- EBIT, amounted to EUR 168 million was affected by the EBITA improvement and showed a significant increase (80.6%) compared to the first quarter of 2023 (€mil. 93)

- The Net result before extraordinary transactions, amounted to EUR 93 million (€mil. 40 in the comparative period) reflected an improved EBIT, partially offset by the higher tax burden recorded in the period

- The Net Result, amounted to EUR 459 million (€mil. 40 in the comparative period) included, in addition to the Net Result before extraordinary transactions, the capital gain recognised after the valuation at fair value of the Telespazio Group, carried out for the purposes of the line-by-line consolidation of the same

Financial Performance

- Free Operating Cash Flow (FOCF), negative for EUR 621 million improving compared to the performance of the first quarter of 2023 (negative for €mil. 688, negative for €mil. 702 in the pro-forma figure), confirmed the positive results reached thanks to initiatives to strengthen operational performance and the collection cycle, a careful investment policy in a period of business growth, an efficient financial strategy and to the actions to rationalize and make more efficient working capital. The figure however highlighted the usual interim trend that is characterised by cash absorptions during the first part of the year

- Group Net Debt, of EUR 2,931 million reduced significantly (about €bil. 0.8) against March 2023 thanks to the strengthening of the Group's cash generation and to the sale of the minority stake in Leonardo DRS occurred in the last quarter of 2023. Compared to 31 December 2023 (€mil. 2,323) the figure increased mainly as a result of the abovementioned usual FOCF performance

SECTOR PERFORMANCE

The Key Performance Indicators of the business Sectors are reported below while pointing out that – starting from 1 January 2024 – the contribution of the Telespazio Group is consolidated on a line-by-line basis in the Space sector. In order to make operating performance comparable, the indicators for the comparative period of the Space sector are provided in this section on a pro-forma basis, including the contribution of the Telespazio Group.

Leonardo continued the path to growth in all sectors of its core business. The trend of new orders, revenues and EBITA by sector was as follows.